Guidance on the chicago checkout bag tax the checkout bag tax bag tax is a 07 per bag tax on the retail sale or use of paper and plastic checkout bags in chicago of which retail merchants retain 02 and the remaining 05 is remitted to the city.

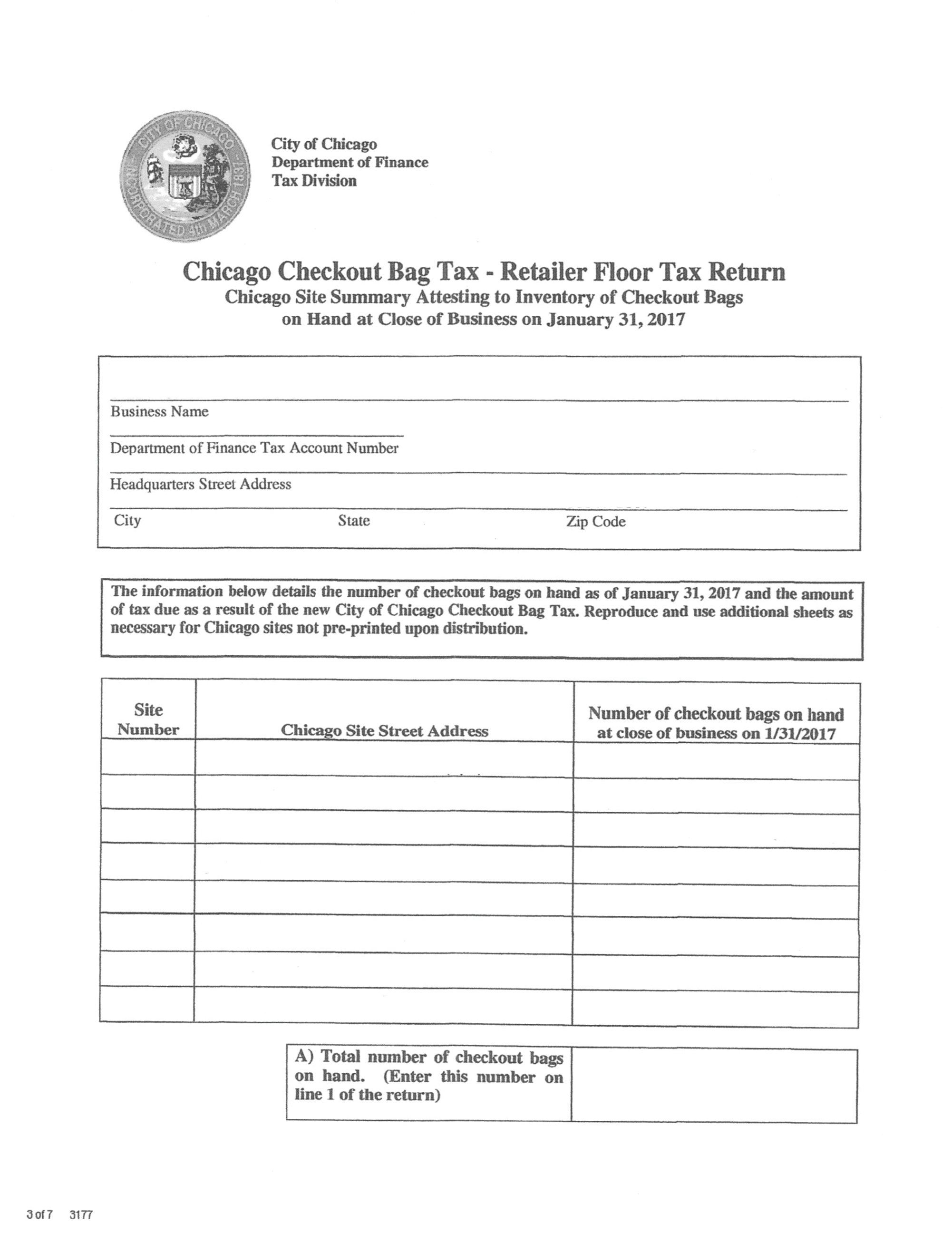

Chicago checkout bag tax retailer floor tax return.

Chicago cbs the city of chicago will halt collection of its 7 cent tax on plastic and paper grocery bags at retail stores until the end of april but that doesn t mean shoppers will stop.

Amusement tax 7510 7510r 7511 bottled water tax 1904 checkout bag tax 2737 ground transportation tax 7595.

Tax is imposed at 0 07 per checkout bag sold or used in the city.

On or before september 20 2017 every retailer of sweetened beverage will be required to submit a floor tax return and remit the applicable tax amount.

The checkout bag tax is imposed on the retail sale or use of checkout bags in chicago.

Chicago checkout bag tax frequently asked questions please consult ordinance for exact terms page 1 of 2 1.

Checkout bag tax 2737 imposed on the retail sale or use of checkout bags in chicago.

Chicago checkout bag tax 3 50 010 title.

Further information will be.

Electricity infrastructure maintenance fee 7576.

Tax returns in accordance with urpo ruling 5 effective 1 1 2016 tax collectors and taxpayers must file their tax returns electronically.

All retail stores must perform an inventory of all checkout bags on hand by the close of business on tuesday january 31 2017.

Cigarette tax 7506 applies to wholesale cigarette dealers.

The store shall include with the tax return any tax due on the inventory of checkout bags in its control and possession for sale or use in the city for which all applicable tax has not been collected.

Tax return form code.

To further help reduce the financial impact of covid 19 on our taxpayers tax payment due dates have been extended as indicated for the following taxes.

What is the chicago checkout bag tax.

The floor tax return must reflect the retailer s inventory on which tax was not previously paid that was in his her possession on august 1 2017.

The store shall in turn collect the tax from its.

It is a tax on the retail sale or use of checkout bags in chicago.

The tax rate is 07 per checkout bag sold or used in chicago with 02 remaining with the retailer and 05 paid to the city.

Exemptions deductions and credits.

This tax shall not apply to the extent it would violate the united states constitution or the.

A floor tax return reporting such inventory must be submitted with payment on or before friday march 3 2017.

/images.trvl-media.com/hotels/2000000/1770000/1760900/1760845/a98ec997_z.jpg)