Income needed for the chase sapphire preferred another important thing to note is that your stated income is definitely a factor that affects your chase sapphire preferred approval odds.

Chase sapphire reserve income requirement.

While chase doesn t list the minimum credit score or income required for the chase sapphire reserve anecdotal evidence suggests at the very least you ll need a credit score of 700.

If your income doesn t qualify you for the high minimum credit limit you ll be unlikely to be approved.

Typically you want an income of at least somewhere in the 40 000 range.

Your total credit limit.

If you re new to credit and have low limits with your other credit cards chase may not be comfortable approving you for 10 000 either.

With the pay yourself back tool your ultimate rewards points are worth 50 more when you redeem them for statement credits against purchases in our current categories.

Credit score required for the chase sapphire reserve.

Earn up to 120 in statement credits on qualifying doordash purchases through 12 31 2021 that s 60 in statement credits through 12 31 2020 and another 60 in statement credits through 12 31 2021.

Your chase sapphire reserve account must be open and not in default to maintain subscription benefits.

Earn up to 120 in doordash statement credits through 12 31 2021.

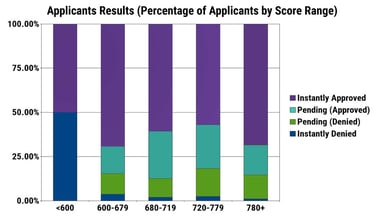

The chase sapphire reserve has slightly stricter approval requirements than its little brother the chase sapphire preferred card reports suggest that you ll typically need a score of at least 720 to get approved for the card though the average score is a bit higher.

Grocery stores and dining at restaurants including takeout and eligible delivery services home improvement stores such as home depot and lowe s and select.

Most people who get approved have scores in excess of 750 which is considered excellent.

The chase sapphire reserve card has a 4 000 minimum spending requirement within the first 3 months of account opening to earn the 100 000 chase ultimate rewards point sign up bonus.

Chase sapphire reserve is a visa infinite card so the minimum credit limit is 10 000.

To meet the requirement you can put ordinary purchases on your card like dining expenses membership fees and health care expenses.

While it would certainly be easier if chase just gave out a magic number the truth is that income is only one factor in the application.